It has been difficult to find any sort of silver lining in 2020. And while we’re still facing collective challenges across all industries, the healthcare industry has seen a glimmer of hope. HW Consulting Group Director Hal Wurtzel discusses what it's like to be a healthcare consulting during a pandemic, how the industry has changed, and what’s next for an industry dealing with so many short-term and long-term unknowns.

We primarily work in four sub-sectors of healthcare: health systems, health payer, dental and other insurance, and life sciences. Providers shifted their focus to front-line service, as they were obviously triaging COVID-19 patients and learning to treat the virus. Life sciences companies also shifted their focus toward therapeutics and vaccine development for the virus. A lot was paused in those markets.

Both health and dental payers, on the other hand, had some very profitable months because claim volume was low. They actually invested—it was an easier time for them to experiment and we saw them work on back-office business processes, technology systems, and other areas that are difficult to change when business-as-usual is busy. On the dental side, they also chose to increase their provider engagement because there was a fear of them going out of business.

While each sub-sector is different, they all experienced a similar cycle during the pandemic: panic, pivot, and then stabilization. Aside from working virtually, in healthcare consulting the overall state is somewhat back to business as usual—patients can no longer delay seeking care for other ailments and elective procedures and they’re also going back to the dentist.

In pharma, there are clear leaders in the race for a COVID-19 vaccine, so the rest are returning to other drugs and therapeutics that pay the bills. However, digital has been accelerated. Most healthcare companies are still in the stone ages of digitization and this crisis has brought us further, faster. We’re helping clients across all sub-sectors in this area—for example, with telemedicine, make it a product that providers can offer, payers can compensate for, and consumers can use.

It has not been all that easy. The initial impression was that we were all going to get time back for not commuting or traveling. But that time has been lost to the inefficiency that comes from not “walking the halls” or having casual interactions with each other and with clients. We like to work elbow-to-elbow with our clients. We co-create and co-ideate, and we enjoy that dynamic. We still have clients whose culture, or Internet speeds, don’t allow the use of video so we can’t read body language or cues. This makes it more difficult in speed and nuance. With highly scheduled, highly tactical days, things seem to take more time.

On the positive side, the virtual nature does give our consultants more time with their family, increased flexibility, and more control over their lifestyle. As a result, we’re beginning to see the possibilities of this allowing some folks to stay in the job longer, which is super positive as we look to increase the diversity of backgrounds in the consulting workforce.

Telemedicine is obviously not a new technology to come out of the pandemic. But its adoption among providers was key to their survival and patients who would have previously dismissed it had to consider it as an option. We’ve seen the data support this: In our survey of 1,500 consumers in three major U.S. cities, we found that their use of telehealth nearly doubled over a six-month period, from 27% before the pandemic to 49%.

We also found that these new habits are likely to sustain. Just having telemedicine is not a strategy, though, and that’s why we’re working with providers, systems, and payers on their overall virtual health strategy. Telemedicine is just one part of an overall experience for patients and should be deployed where it makes the most sense—our survey showed people are more likely to use it for services like lifestyle support and primary care and less likely to use it for eldercare and specialist visits.

The biggest opportunity is the acceleration of digital. It’s no longer a choice, and there is an insistence—not just from the executive team, but from all stakeholders—that the healthcare industry does things differently. A specific example would be the pre-validation and paperwork you fill out at the doctor’s office—the push to make that self-service and digital during the pandemic was huge. Healthcare is still behind other industries and the opportunity is finally here to collectively elevate the ecosystem.

The pandemic, I think, has gained the buy-in of the industry and all the folks who work within it to be more digital-forward, more patient-centric, and understand that these goals are actually achievable—that they can actually administer healthcare differently.

I hope the spotlight on the inefficiencies has given way to the much-needed improvements and will outlast the immediacy of the pandemic. The continuation of digital is an imperative and the combination of business and technology consulting needed to support this, we feel, positions HW Consulting Group very well.

The state of COVID-19 definitely plays a role: If it comes back with a huge resurgence, it keeps the focus on the overwhelming demand on providers and increases pressure on life sciences companies. It could also shed light on insurers that continue to collect premiums while services go unused. Several car insurance companies refunded premiums during the pandemic because people were driving less often—people may start demanding the same from health insurers. We may also see more people become unemployed and lose their health insurance, which affects the entire ecosystem’s ability to take on the improvements that they need to.

In many ways, the health of individuals and the health of companies are not so different. For both, staying healthy requires maintaining good habits, making changes based on new information and research, and occasionally undergoing large scale interventions.

It’s ironic, then, that while tasked with ensuring their customers’ health and well-being, many payers are suffering from technology inertia that threatens the health of their own organizations. In this age of fast-moving digital technology, alert competitors, and heightened customer expectations, commitment to inflexible and outdated technology systems has burdened many health plans.

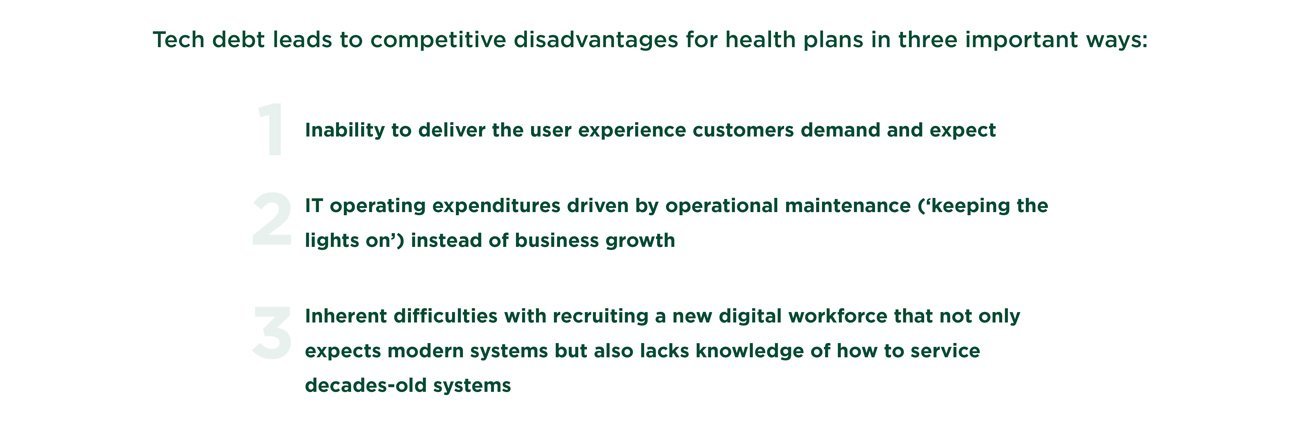

Technology debt may not appear on the balance sheet, but, much like financial debt, it imposes limitations on an organization’s ability to adapt, grow, and develop. Tech debt can accrue for numerous reasons, including a lack of collaboration, poor technology leadership, and, most commonly, business pressure. Obsolete legacy systems not only impose draining costs on operations, but they can also limit the ability to roll out new products, adapt to market shifts, and stay ahead of the competition.

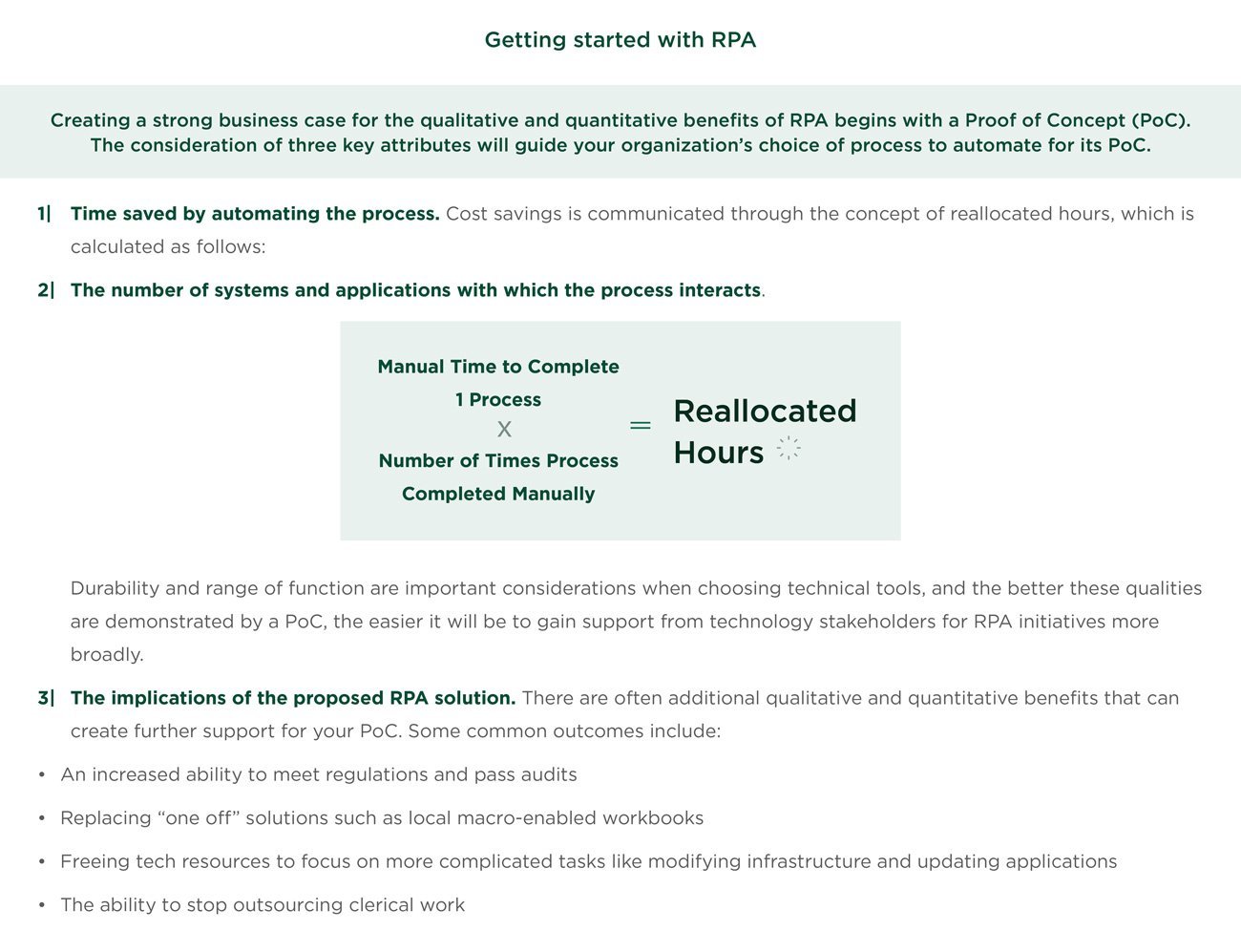

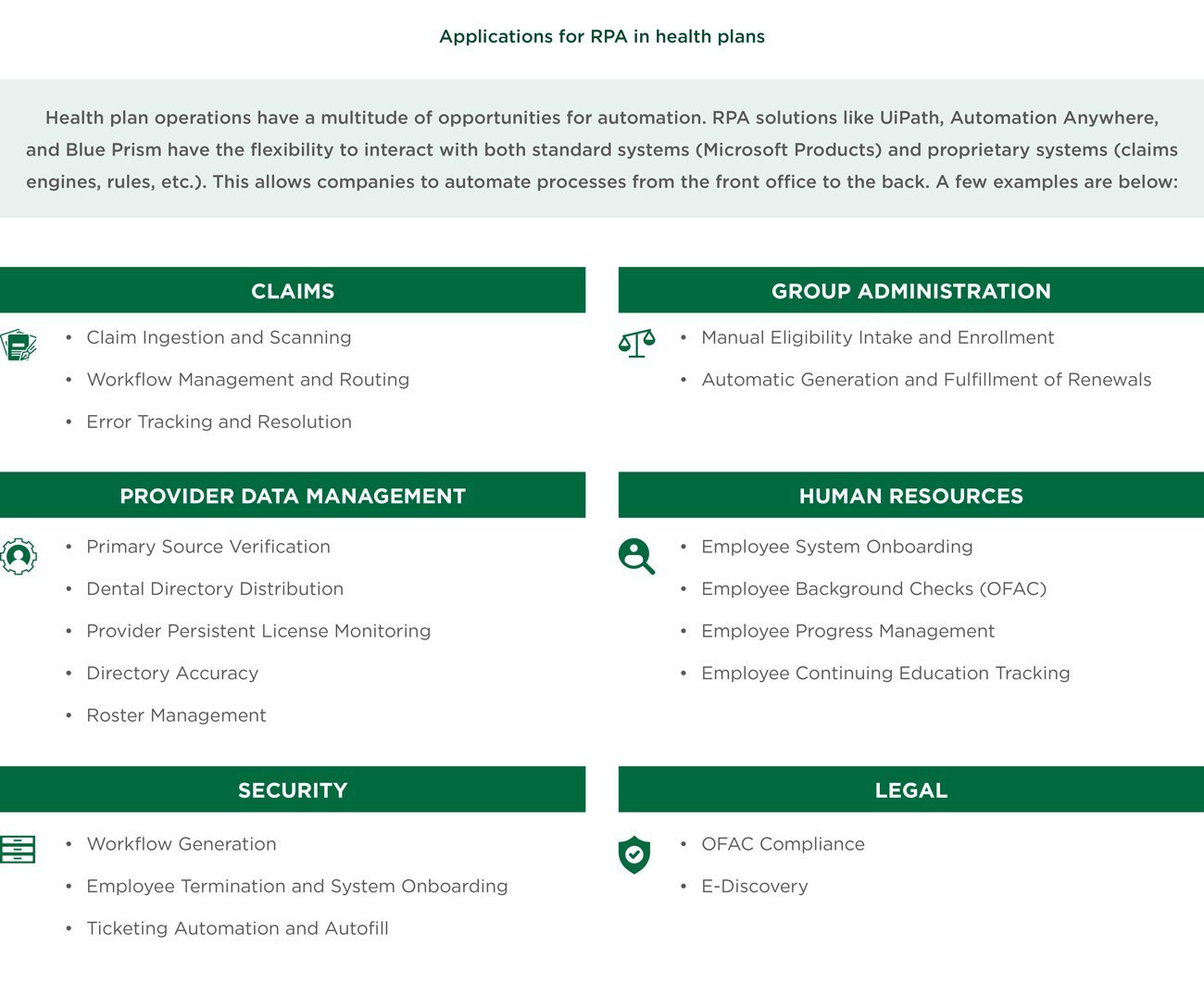

To effectively combat tech debt and its tendency to stifle an organization’s ability to embrace more nimble digital technology, health plans should consider automation solutions as an alternative to the quantum leap to new systems. Taking this approach can immediately improve operations, allay business pressure to modernize and evolve, and buy time for an organization to identify and implement appropriate solutions in line with its broader technology and business strategies. In our experience, robotic process automation (RPA) affords health plans a unique opportunity to start tackling legacy tech debt while instilling the flexibility needed to spur digital advancements.

Technology debt accrues when software and hardware decisions are made by prioritizing the ease or low cost of a solution in the short-term instead of considering the long-term benefits of an organization’s true desired state of operations. And as tech debt builds over time—often due to fears of large financial and time investments and uncertainty over what to prioritize and how to begin—it creates conditions that make course shifts even more difficult.

All industries are vulnerable to these dynamics, but the healthcare industry specifically has lagged in its ability to move to digital operating models and break free from legacy systems. From the perspective of health plans, this has resulted in organizations effectively cutting themselves off from new technologies that can automate processes, improve employee work experiences, meet consumers’ elevated expectations for digital experiences, and ultimately deliver better business and patient results.

But the trouble extends beyond internal decision- making. Much like the financial services industry, health plans are subject to a volatile regulatory environment. Keeping up with daily CMS changes is a challenge even for organizations with newer platforms, let alone those with the obsolete technologies still commonly in use.

For instance, one such mandate required contact centers to identify and follow a set list of questions for assisting Medicaid participants. While seemingly simple, this requirement necessitated an investment of nearly $2 million.

The origins of tech debt reveal the intersection of two very real, understandable impulses: short-term, practical solutions that are needed to address immediate issues, and the power of incumbency fueled by the fallacy of sunk costs. The day-to-day drivers of tech debt often arise from practical concerns, and the very real imperative to address critical immediate issues often leads decision-makers to lose sight of the bigger strategic picture.

But operating in this mode over time is dangerous. It traps IT departments in a cycle of ongoing application maintenance. Over time, years of patches and short- term fixes to a legacy mainframe technology create vulnerabilities to service provider changes and place rigid limitations on customer experience.

New technology is also intimidating. Recent popular narratives in the news cycle also have exacerbated fears about the negative impacts of new technology like automation. The benefits of digital technology are often underappreciated for the value they can bring when jobs and organizations are redesigned for the new digitally-enabled workforce.

The narrative surrounding automation often focuses on change, transformation, and the prospect of job elimination. Instead, organizations should concentrate on automation’s very real downstream benefits. In addition to improving productivity and efficiency, automation has also proven successful in freeing employees from repetitive, low value-added tasks, enabling them to focus on more creative, business-driving activities.

Unless organizations can overcome the paralysis caused by practical concerns and fears of change in order to adapt and evolve, they will inevitably be outpaced by newer digital entrants to the industry and find themselves mired in cost-and time-intensive technologies and processes.

Health plans of all sizes need to evolve their legacy environments. Siloed and paper-based operations with custom-built platforms must move to more flexible, streamlined, configurable, digitally-enabled solutions. In the past 5 to 10 years, adjacent consolidation in the health plan arena has narrowed market participants, creating additional pressures to transform—a recent AMA study found that “nearly 7 out of 10 commercial markets have a significant lack of competition, with 9 in 10 of the health insurance exchange markets lacking competition.” Pairing this narrower market with ever-higher consumer expectations and internal financial considerations around administrative spending and government reimbursement rates, health plans driven by flexible systems will find more success when pursuing adjacent acquisitions of other health plans or vertical opportunities with health systems.

Over time, years of patches and short-term fixes to a legacy mainframe technology create vulnerabilities to service provider changes and place rigid limitations on customer experience.

RPA offers a way forward. This class of software, which facilitates the automation of highly manual and repeatable processes, has had notable success in the financial services industry. The technology provides immediate, practical solutions and can evolve with a health plan’s journey to digital transformation, rather than being yet another stopping-off point in the accrual of tech debt. RPA is amenable to a digital workforce and offers much-needed scalability, opening the door to more advanced technologies like artificial intelligence, machine learning, continual learning, and deep learning.

In other words, RPA is an onramp. It uniquely challenges companies to reinvent themselves, allowing them to start the digitization process at a more manageable pace. That reinvention is not just about technology but about an organization’s thought process around innovation and operations in the context of healthcare’s particularities.

Often, many decisions relating to technology enhancements are made from a business perspective, creating pressure on technology departments to continue delivering new enhancements at the cost of overall system health. Solving for both sides of that conundrum, RPA is a conduit for quick, low-cost business wins while accelerating development on systemic technology issues (instead of developing solutions in python or java, for example, technology departments can deploy a low-cost RPA solution). An organization can start with what’s familiar, automate the current-state process, and then, once the organization has gained its footing, operating in a hybrid traditional-digital manner, begin to branch into other emerging technologies like AI and machine learning.

Consider the following illustration of the value that RPA can deliver. A large health plan was organizing a feature to improve their process for managing contract renewals because their existing system was unable to support automatic renewal generation. This required users to go through each subgroup and manually generate nearly 10,000 contracts each year. The proposed feature would alleviate this manual burden but also take 500 hours to develop while exposing the underwriting system to unknown risk. Business pressure mounted, and the organization needed to do something.

They turned to RPA as an alternative. With a commitment of only 20 hours, the RPA team was able to develop a robot that not only solved the problem at hand by automating the creation and fulfillment of 10,000 renewals but also freed the technology team from its 500-hour proposal to work on more pressing issues.

While small, this example is indicative of opportunities organizations have to embark on significant change with manageable steps. RPA can be a bridge from a state of technology debt to one of digital enablement. It’s a means to an end—creating a path to digital transformation while providing relief to CIOs and CTOs who are frequently forced to “do it quick” rather than “do it right”—without bankrupting an organization on high- risk technology overhauls.

The longevity of health plans will be increasingly defined by their ability to align, execute, and adapt to market realities faster than their competition. At scale, RPA can reduce keeping-the-lights-on activities by 10% and enable technology teams to shift attention to system issues and advancements. These benefits extend to the business, too, taking some of the pressure off decision-makers around how to approach their organizations’ needs for further evolution and development. With RPA as a quick, smart solution to identified inefficiencies, business and technology stakeholders alike will see immediate benefits in time and money saved, while cultivating goodwill at both ends of the table.

RPA can be a bridge from a state of technology debt to one of digital enablement.

As metaphors go, if AI is the brain/cognition, automation technology provides the hands that execute those decisions. Many organizations consider RPA to be the “walk” before the “run.” The workforce must first be comfortable with the notion of digital capability before they can be expected to embrace technology governed by algorithms and cognition.

It is not realistic to jump from siloed legacy systems and manual processes to complex instruments like machine learning, natural language processing, or other growing technologies. The ability to lay the foundation for those advanced technologies with RPA and set the stage for a coordinated, multi-year transition to greater digital capabilities is critical to any health plan looking to secure and grow future value.

RPA is a stepping stone in that journey and an alternative to hastily committing to an enterprise system that may not fit an organization’s immediate needs—and could even jeopardize its long-term goals. As such, RPA isn’t “the new, new thing.” Rather, it is a pragmatic first step for organizations willing to reinvent themselves for the modern market by enabling innovation through the automation of tasks with existing technology. Taking this approach allows an organization to improve efficiencies while buying time for and alleviating pressures around more complex advancements.

Traditional, established health plans often struggle under massive amounts of technology debt. Without addressing that debt, those plans will not be able to truly innovate to meet the demands of changing market dynamics and consumer expectations.

Newer entrants into the industry are at an advantage because they are more easily able to adopt newer, flexible technology, specifically automation. RPA provides a gateway to innovation and broader digital transformation for legacy companies to streamline existing operations and emerge from tech debt-compounding habits as they strive for a balance between “keeping the lights on” and true competitive advantage. RPA allows its adopters to interact with new and nimble technology, improve operations, and free-up employee time for more meaningfully tackle technology debt and innovate for the future.